The Definitive Guide to Do I Have To List All My Debts When Filing Bankruptcy in Virginia

Two many years for Chapter seven bankruptcy (You'll need the two many years to finish the paperwork and the most recent yr to the bankruptcy trustee.)

A collection company can Get in touch with Others to understand your handle, your house cell phone number, and in which you function, but commonly it may’t contact them over after, and it may in no way convey to them you owe a personal debt.

These scenarios are “great” for managing in the Chapter 13 procedure. With regard to your home, if you believe that you'll be able to make all future normal month-to-month payments, and might also afford to pay for to help make an additional payment to retire the arrearage, you'll likely be able to maintain your house out of foreclosure.

Quite a few detrimental things make this a risky credit card debt-reduction solution, however, if it retains you from being forced to file bankruptcy, it’s in all probability worth it.

When you ask about your financial debt, keep in mind that in certain states for those who acknowledge in writing that you owe the debt, the clock resets in addition to a new statute of constraints time period starts.

When you’re in a condition where by a credit card debt collector can Get hold of you a couple of time-barred debt, they can hold making contact with you by mobile phone, e-mail, or letter to try to collect Anything you owe.

His curiosity in sports has waned some, but he is Home Page as passionate as at any time about not achieving for his wallet.

In some cases, you might be allowed to speed up your payments and look for an early discharge from your agreement. Conversely, In the event your money problem worsens, it’s your decision to tell the chapter 13 bankruptcy trustee and seek a modification on the prepare.

• Distinguished: A superb ranking for an attorney with a few practical experience. This ranking this article suggests the legal professional is widely highly regarded by their friends for top Qualified accomplishment and moral requirements.

The attorney or legislation business you are getting in touch with is not required to, and will opt for to useful site not, accept you as being a consumer. The Internet is just not essentially safe and e-mails despatched through This web site may very well be intercepted or read through by third get-togethers. site Thanks.

When filing for bankruptcy in Ohio, the debtor can hold a restricted volume of home, belongings and revenue. The commonest is called the ‘homestead exemption,’ which lets a debtor to retain his / her Most important residence. In Ohio, this now applies nearly an equity worth of $136,925.

In certain states, if you create a payment as well as acknowledge in composing that you owe the personal debt, the clock resets plus a new statute of constraints interval commences. In that circumstance, your financial debt is now not time-barred.

These aiming to consolidate credit card debt commonly have two unique choices. A 0% important link desire, stability-transfer credit card includes transferring debts onto the cardboard and paying the balance in comprehensive all through a marketing interval.

Even so, it is vital to know that not all debts are exactly the same in the Chapter thirteen bankruptcy. Debts will likely be classified from the bankruptcy trustee into three classes:

Patrick Renna Then & Now!

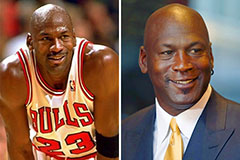

Patrick Renna Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now! Bernadette Peters Then & Now!

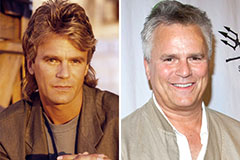

Bernadette Peters Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!